By Mike DelRose Jr.

Friday, October 31st, 2025. 10:34 AM

Belmont, MA

Happy Halloween! What a strange time to be in real estate, or life for that matter, but I digress. Market shifts are expected, cyclical, an often have reflected long-term trends. This market now is ambiguous at best. When I first started in the industry in 2009 the market was non existent. Properties sat for months, buyers didn’t really have the money to purchase homes, and lenders were hesitant to spot you $5 for coffee. I remember getting a client a great Cape in Metro West for a price around $250,000! What a great year to graduate from college by the way (Work hard they said. Study hard they said. Great opportunity they said). But even in that market the data was persistent and the sentiment remained true for the next two years before taking a turn that was clearly palpable.

Many sellers that inadvertently listed too late in the Summer this year came to the harsh realization that pricing wasn’t what it was a couple of months prior. Remember that listing data is always 60-90 days old. But even when the market took a breather at times over the last couple of years, things were still going strong. Throughout much of 2025 we professionals were being told from lenders issuing pre approvals and applications that they were getting busier. Even though inventory was coming up year over year, business was still strong based on so much demand spillover. The promise of the reduction in mortgage interest rates was also short lived. But we’re in Greater Boston, we’ll be fine….

The oddest part about the Fall right now, is that every indication of market strength or weakness is being seen on a case-by-case basis. Locations, property types, price points, and even specific properties are all having their own experiences. Earlier this month, a client of mine successfully beat out 9 other offers to secure a home they had been searching for over the last year. The trade-up market in that community had been extremely competitive over the past 24 months. A listing of mine in the same community in a slightly, but not drastically lower price point, received only a couple of offers. Despite a great selling price with competition, and happy clients to boot, buyers noticeably took their time after the first weekend of open houses before expressing interest in presenting offers. Of the dozen or so buyers through the open houses or interest expressed via their agent showing serious interest, only a few took the next steps. The house was immaculate by the way. The 80-20 power rule, otherwise known as the Pareto Principle, was on full display here, with 20% of the traffic submitting offers, and causing 80% of our potential opportunity to sell.

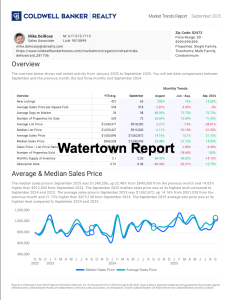

If you take a look at the Belmont report for example, you will see an increase in supply of homes, a decrease in number of homes sold, and a correlated decrease in absorption rate to reflect the two figures. I love the absorption rate because despite the lagging data, you really can get a feel for what a potential search is going to look like or more accurately predict activity on an upcoming listing. In Belmont and Watertown, our two primary market with office locations, that figure still remains in the mid-20% range. Listings still have a slight edge, but buyers are playing ball instead of overbidding.

When we’re thinking about pricing a listing or preparing a market analysis in terms of gauging a solid offer price, we provide values in ranges to account for varying preferences and subjective tendencies. However, when we’re analyzing the market as a whole across all price points, we really want to avoid averages and focus on the median. With traditionally lower inventory, one $3M+ property can throw off our perception of price points between $800,000 and $1.5M. In our analysis here, its clear that prices have still risen over the past 12 months, but have come back down to earth after a big boom at start the year.

On to a more depressing reflection on our current market; Wonder why the rental market has absolutely tanked? Watertown, at time of writing has 94 rental properties listed through MLS. Belmont has 37. After removing 1 listing from the total for having a $17,000/month rent. We’re looking at an average monthly rent just shy of $3,400/month, with days on market a hair under 2 months. Yikes. Mind you, while I personally avoid the rental game, I don’t remember the last time I rented a unit in Watertown or Belmont that didn’t have dozens of potential applicants.

Well no wonder the market is ambiguous! Investors and landlords have been sidelined which takes competition and demand from other residential listings. In Greater Boston we have desirable educational systems, higher education, hospitals, and biotech that has attracted people from all over the …. oh…. Could our current market economics be tied to the cancellations of visas? It may not be the only reason but it sure looks like it isn’t helping. I’m not sure of the amount of people avoiding coming here at time of writing, but I would not be surprised to see the fear from sectors like education may be spilling over to other industry as well. Regardless of the reason, the rental market is soft. With new state regulation that requires brokerages to only take fees or commission from those they actually represent, any positive impact of the new transparency and fairness regulations seem to be overshadowed by doom or gloom here.

This market segment really reminds me of the recession. I can’t tell you as a buyer, seller, or renter there will be less risk by making moves now. But what I can say is that historically, in several years many will look back at this time period and wish they had or were at least able to make a purchase or sale position to bolster their portfolios.

Do you know what I’m really high on right now? The Patriots. I had them at an improved 7-9 wins this year and they appear to be blowing by those expectations. Really, I was just hoping for more than the paltry 4 wins from 2024, and a much improved Drake Maye. In reality, we have a quarterback that has not only exceeded expectations for a 2nd year starter, but has surpassed many of his quarterback peers, landing him in elite company with the leagues best. Anything can happen of course, and I can’t be too upset by a little heartbreak at the end of the season, however the last 5 games has shown consistency at quarterback on a level we haven’t seen since, bless his name, Tom Brady. On a side note, I peaked as a real estate professional when I was quoted in a Forbes article talking about his property a few years ago. Anyways, I’m excited for football again.

Because it is the final day of spooky season, and I haven’t really been able to do anything on theme, I’ll have you check out the Spooky Real Estate blog article I wrote in the past. Case law is fascinating, and real estate case law is My jam. Anyways, haunting are real according to courts and you should read to find out why.

Lastly, as we approach Thanksgiving and the season of giving back, I want to turn your attention to a great cause our team is supporting. As many of our clients know, we have hosted events at our office and handed out Thanksgiving Pies along with a cocktail party. Loads of fun and we hope to get back to that at some point. This year, however, we are partnering with an organization called Community Servings. We are selling pies with all proceeds going the toward providing scratch-made meals to individuals with chronic illness and their families who are facing food insecurity. With SNAP benefits being tabled for the month of November, our humble fundraiser has become much more important. Pies can be purchased from our Seller page for $35.00, and picked up on Tuesday, November 25th, 2025, between the ours of 12:00 PM and 6:00 PM at our office located at 130 Concord Ave, Belmont, MA 02478. We’d love to see you, and appreciate any effort put toward the cause.

This rambling, sorry excuse for a blog entry was proudly written by Mike DelRose Jr., and not ChatGPT, although it probably should have been.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link